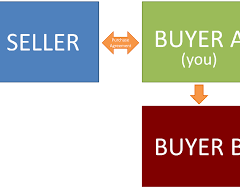

Assignment of Contracts: What You Should Know

Recent media reports in British Columbia have brought property assignment, also called “shadow flipping,” into the public conversation. We understand real estate professionals and consumers may be concerned about these activities because of the media reports, but the situation is different in Alberta. Property assignment is typically a more common practice in rising markets and where there is a significant influx of foreign money;...

Homes near new arenas can expect increase in real estate value

New Research by the Real Estate Investment Network which Glen Godlonton is a member of States: The construction of new arenas and stadiums has a positive impact on real estate values for nearby homes. “A key highlight of the research findings is: Homes in neighbourhoods close to new stadium builds — or proposed stadium builds — on average, have premiums ranging between three per cent and 15 per cent, depending on the different types...

THE CTRAIN EFFECT

Analysis shows inner-city real estate prices uneffected by LRT Here is a summarized version of CREN Article Since 1981, the CTrain has transformed how Calgarians get around town. Yet what impact has the city’s light-rail transit system had on property values? And do they truly become selling features when buying or selling homes? An analysis of inner-city communities along the West LRT line, which opened in December 2012, show average...

Locked In or Floating Rate-The Variable Mortgage Rates Dilemma

Locked In or Variable Rate Mortgages Lock in or float? This article from the Vancouver Sun suggests floating remains a good choice for many borrowers: Michael Kane Vancouver Sun HOME LOAN DILEMMA: TO LOCK IN OR FLOAT: Kelly Patterson, a mobile mortgages manager with VanCity Credit Union, says the posted rates used by financial institutions let them offer discounts of at least one per cent. Interest rates...

Downsizing in a Strong Real Estate Market

Downsizing in a Strong Real Estate Market Are you an “empty nester” who needs a home for the future? Is it time to downsize or to move into another home more suitable to your retirement lifestyle or soon to come retirement lifestyle? Canada’s population is aging; it’s a fact, plain and simple. The latest statistics show that a greater than ever portion of the Canadian population is made up of people...

What Drives Variable and Fixed Mortgage Rates

What drives Variable and Fixed Mortgage Rates Well then…the Bank of Canada (BoC) sure surprised most Economists this morning by lowering the Overnight Rate. Now the banks normally, but not always, follow changes in the Overnight Rate with the same change to their Prime Rate, which of course impacts Variable Rate Mortgages. So we will probably see the banks sometime this week to follow suit by lowering their Prime Rate from 3.0% to...